Advertisements

3 ways to use the app to organize your financial life without stress

A good tool is useless if it is not used well. So, rather than downloading the app and forgetting about it, the important thing is to integrate it into your routine. And the best part is that you don't need to do everything at once: you can start with the basics and move forward step by step.

Next, I show you three effective ways to use the app, depending on your comfort level, your goals, and the time you have available.

Advertisements

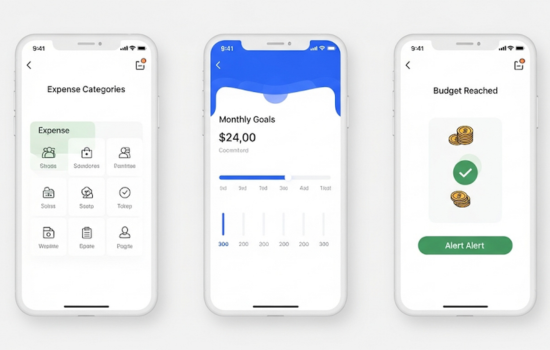

Option 1: Expense control by category

Ideal for those who have no idea what they spend, but want to know.

By connecting your accounts or manually recording your transactions, the app categorizes everything into categories like food, transportation, entertainment, health, and more.

Advantages:

- Clear and automatic display

- You detect invisible expenses (such as subscriptions or delivery)

- You can see weekly or monthly trends

Disadvantages:

Advertisements

- Requires account registration or synchronization

- Some categories may need manual adjustments

- It may cause surprise or discomfort at first (but that's good!)

See also

- Pulse Tea: Take care of your heart

- Awakening Tea: Increases your energy

- How to Track a Lost or Family Cell Phone

- The Best Apps for Viewing Cities with Satellite Images

- Apps to monitor WhatsApp and messaging

Option 2: Monthly planning with realistic goals

A useful feature for those with a fixed or variable income who want to avoid running out of money at the end of the month.

It allows you to set how much you want to spend in each category and see, in real time, how much you have left.

Advantages:

- It forces you to think before you spend

- Help create a “spreadsheet-free budget”

- Generate alerts when you are about to overstep

Disadvantages:

- It may take a few days to adjust the initial goals.

- If not used daily, it loses effectiveness.

- It requires consistency (even if it's just 3 minutes a day)

Option 3: Synchronization with bank accounts + alerts

For those who want everything automated. You can link your accounts and cards, and the app automatically records transactions, classifies them, and alerts you if anything is out of the ordinary.

Advantages:

- Zero manual loading

- It works as a silent “watchman”

- Ideal for busy people or those with multiple benches

Disadvantages:

- Some people have security concerns (even though the system is encrypted)

- Requires trust in the app and initial settings

- May generate excessive notifications if not configured properly

Quick comparison

| Function | Category Control | Planning with Goals | Synchronization + Alerts |

|---|---|---|---|

| Ideal for… | Beginners | Users with regular income | Busy people or tech |

| Level of automation | Half | Half | High |

| Difficulty of implementation | Low | Average | Medium-high |

| Needs daily discipline | Yeah | Yeah | No (if everything is linked) |

| Level of customization | High | High | Average |

| Alerts and reminders | Optional | Yeah | Yes (intense) |

Which one to choose?

- If you are just starting out, use only category control to gain awareness.

- If you already have an idea of your income, set goals and limits by area.

- If you prefer not to touch anything, sync everything and let the app work for you.

There is no single right path. The key is that Organizing your financial life doesn't become another burden, but a tool that frees your mind and your time.

And how do you maintain the habit without giving up after two weeks?

In Part 3, I showed you how to raise a simple rotina, without pressing, so that the app really works not every day — along with the practical and care advice that many people use.

Would you like to turn this app into your best financial ally?

So don't stop. What follows will make it much easier.